Bankruptcy and Credit Scores: What You Need to Know

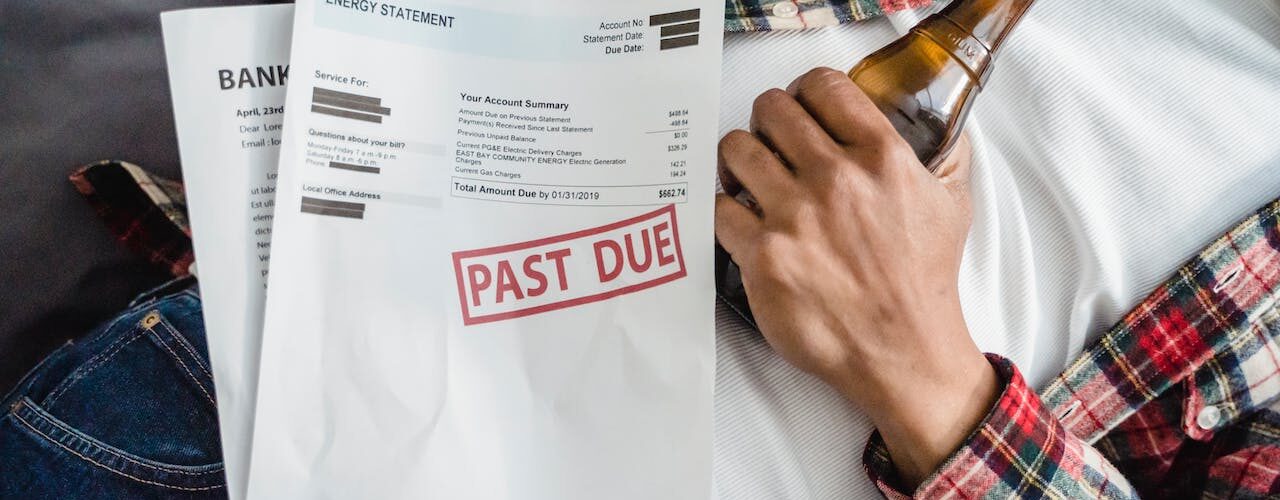

Bankruptcy is a word that can carry a heavy burden. When financial challenges become overwhelming, some people turn to bankruptcy as a last resort. It’s a legal process that can offer a fresh start, but it also has significant consequences for your credit score. Moreover, can someone with good credit help someone with bad credit? Well, it’s not that simple, and here’s what you need to know.

Understanding Bankruptcy

Bankruptcy is a legal process that allows individuals and businesses to discharge or restructure their debts when they are unable to meet their financial obligations. It provides relief from overwhelming debt, but it’s not a decision to be taken lightly. When you file for bankruptcy, your finances come under the supervision of a court, and your assets may be used to repay creditors. In return, your debts are either discharged or restructured according to a court-approved plan.

The Impact on Your Credit Score

One of the most significant concerns when it comes to bankruptcy is how it affects your credit score. Bankruptcy can have a substantial negative impact on your creditworthiness, and the extent of the impact varies depending on the type of bankruptcy you file:

- Chapter 7 Bankruptcy: This type of bankruptcy involves the liquidation of assets to pay off debts. It remains on your credit report for ten years, and it can significantly lower your credit score. Lenders may be cautious about extending new credit to you after a Chapter 7 bankruptcy.

- Chapter 13 Bankruptcy: In Chapter 13 bankruptcy, you create a repayment plan to settle your debts over three to five years. This type of bankruptcy remains on your credit report for seven years. While it has less impact on your credit score than Chapter 7, it still affects your ability to obtain new credit.

Rebuilding Your Credit After Bankruptcy

While bankruptcy can have a negative impact on your credit, it’s not the end of your financial story. You can take steps to rebuild your credit and regain your financial footing:

- Create a Budget: Start by creating a detailed budget to manage your expenses and ensure that you can meet your financial obligations.

- Secure a Secured Credit Card: Consider applying for a secured credit card, which requires a deposit as collateral. Using this card responsibly can help rebuild your credit.

- Make Timely Payments: Pay all your bills on time. Consistently making payments is one of the most critical factors in rebuilding your credit.

- Keep Credit Balances Low: Try to keep your credit card balances low in relation to your credit limit, as high credit utilization can negatively impact your credit score.

- Seek Professional Guidance: Consider working with a credit counselor to develop a personalized plan for improving your credit.

In Conclusion

Bankruptcy is a challenging and sometimes necessary step for those facing overwhelming debt. While it does have significant repercussions for your credit score, it doesn’t mean the end of your financial stability. With dedication, discipline, and a well-thought-out plan, you can rebuild your credit and move forward on the path to financial recovery. Remember that, despite the setbacks, there is always hope for a brighter financial future.