The Ideal Ways to Boost Your Credit Score

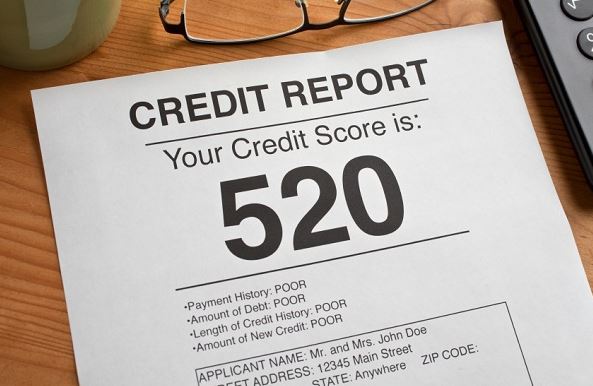

One of the things that has stopped many from acquiring loans is a poor credit score. You may end up getting disappointed, especially when you need money urgently to service your needs. Banks and lenders, with the help of credit bureaus, usually monitor the repayment habits of some of their clients. Those who make late repayments receive a low credit score.

Some people fail to pay anything at all on the agreed date. This can get you blacklisted completely. There are loans you can access even with a poor credit score. You should try personal loans that have very minimal requirements for you to qualify for one. Some essential things these lenders look for is your personal information and employment status. These are enough to prove that you are eligible for a loan.

The other way you can get a loan with a poor credit score is by presenting a guarantor. This is a person who will be put to task if you fail to pay your loan on time. They will be responsible for your payment. Providing some of your assets as security is the other option you have. You should work on building your credit score to avoid missing out on loans. Here is what you should do to improve your ratings.

you fail to pay your loan on time. They will be responsible for your payment. Providing some of your assets as security is the other option you have. You should work on building your credit score to avoid missing out on loans. Here is what you should do to improve your ratings.

Borrow Wisely

Make sure you borrow an amount you are able to pay to avoid struggling with your loan repayment. The money borrowed should be used on other income-generating activities that help you recover money to use for your repayments. Most people who borrow for leisure reasons end up struggling with paying back their loans. Make sure you plan and use your money wisely to avoid disappointments.

Partial Payments

You can repay the amount partially to complete your repayment on time. This could be every week or intervals that match with your agreed repayment period. It is one of the best options that can help you complete your repayment on time. The best thing to do is to set reminders that will keep you notified of your repayment dates.

Timely Payments

This is the best option if you want to build your credit score. You should not wait for the final day to start making your payments. Paying your outstanding loan even weeks before the deadline date will help to improve your credit score. The best thing to do is set reminders that will help you beat your deadline.

Paying your outstanding loan even weeks before the deadline date will help to improve your credit score. The best thing to do is set reminders that will help you beat your deadline.